Coinbase strikes back: Keeping on the front foot against the SEC

With a data breach, an SEC investigation, and a sharp decline in its share price, Coinbase is navigating some choppy waters.

Trouble at sea

Although Coinbase has faced some negative news this week, the exchange is seemingly taking control of the narrative and doing its best to get on the front foot.

An SEC investigation is currently underway into some allegedly incorrect reporting made back in 2021 on Coinbase’s “verified” user numbers and monthly transaction volumes. The exchange stopped using these figures in 2023 — something investigators will likely want to hear an explanation for.

The market at that time was awash with new entrants chasing the bull market, so it could be a case that the US exchange’s onboarding procedures were not up to scratch to properly handle the massive influx of new users and ensuring they were properly “verified”.

What makes this a year of particular note for the SEC’s investigation is that in April ‘21 Coinbase went public with its IPO (initial public offering), listing its shares on the Nasdaq.

Public companies have more responsibilities than privately owned ones, which could make this a devastating case for Coinbase if they are found to be at fault. The SEC has a responsibility to investigate where they suspect investors have been misled, as the incorrect reporting could mean Coinbase’s share price was overvalued.

News of the investigation, alongside a recent hack, have caused Coinbase’s share price to fall by around 7%. The hack was achieved using social engineering to bribe customer support agents working for the exchange in India to pass on customer account info to the hackers. This will have alarmed investors and raised concerns on the robustness of Coinbase’s operational procedures.

White‑shoes and lobbying: Coinbase fights back

To stay on the front foot, Coinbase has hired white‑shoe New York law firm, Davis Polk & Wardwell.

Davis Polk & Wardwell is a titan of a law firm for financial services. They represented a number of banks during the 2008 financial crisis, and helped to draft financial reforms for Congress in 2010.

The fact that such a firm has taken the case is a show of strength by Coinbase, showing the SEC they’ve hired a heavy‑weight law firm with extensive experience in navigating the financial services regulation.

Bringing a premier law firm on the books, as well as offering a $20 million bounty for information leading to their alleged hackers can’t be cheap. However, once we combine in the $300 million Coinbase has promised to return to defrauded customers, we could be looking at an expensive year for the exchange.

Coinbase co‑founder and CEO Brian Armstrong has been tweeting out about recent congressional meetings he’s attended that are currently discussing stablecoin regulations. Armstrong, then, is seemingly at the forefront of lobbying Congressmen to create favourable regulations for the exchange and the wider market. A coherent stablecoin framework could be a positive boost for Coinbase’s operational capacity, with stablecoins potentially reaching into new areas of the financial system.

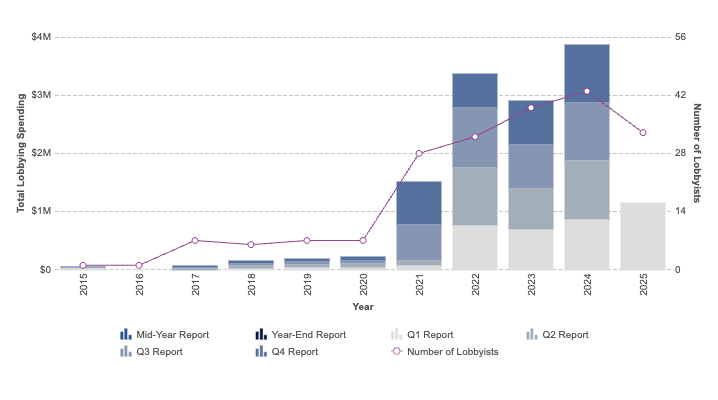

According to data by OpenSecrets.org, Coinbase has increased its lobbying significantly over the last few years, reaching a peak of just under $4 million in 2024.

Source: OpenSecrets.org (Lobbying Data)

By leveraging political power in Congress, combined with Trump in office and former SEC head Gary Gensler out of the way, Coinbase is seemingly making use of its significant war chest to go on the offensive against the SEC to stay on the front foot.

The rest of the market will be watching with interest to see how this battle plays out. Can Coinbase maintain this momentum? Can it retain the trust of its users and expand the use cases of crypto in the financial system? Time will tell.